Calculating your income tax can be tricky, but Excel’s IF formulas can help make it easier. In this guide, we’ll learn how to use “IF” formulas to figure out your taxes payable amount.

Whether you’re new to Excel or already know your way around, this guide will show you how to use “IF” formulas to calculate income tax with confidence.

Calculate Income Tax In Excel With “IF” Formulas:

Step 1:

Open Microsoft Excel new sheet

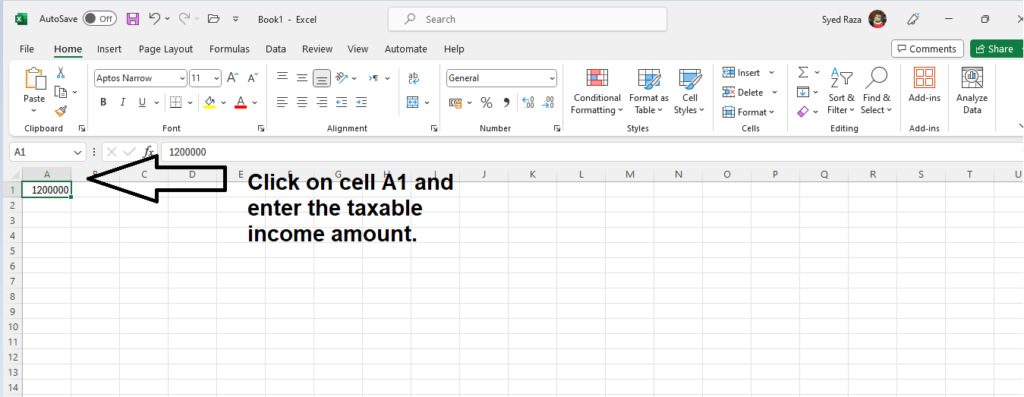

Step 2

Click on cell A1 and enter the taxable income amount.

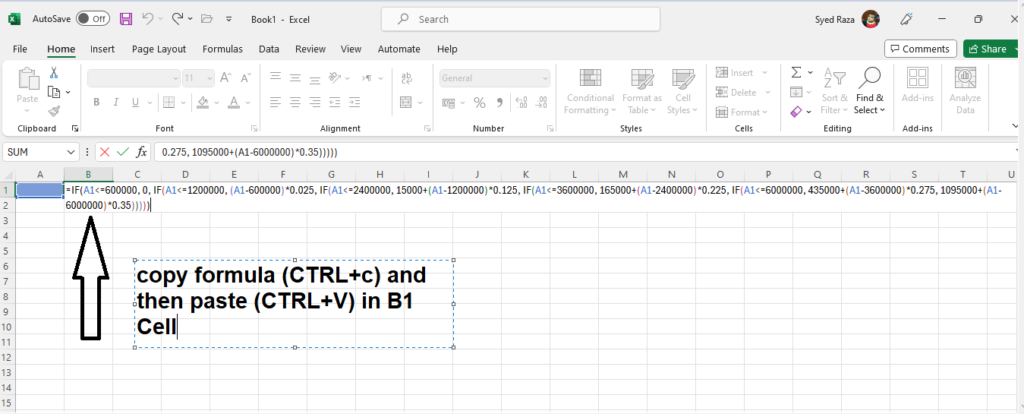

Step 3

Now select cell (B1), Copy (Ctrl+C) the following formula:

=IF(A1<=600000, 0, IF(A1<=1200000, (A1-600000)*0.025, IF(A1<=2400000, 15000+(A1-1200000)*0.125, IF(A1<=3600000, 165000+(A1-2400000)*0.225, IF(A1<=6000000, 435000+(A1-3600000)*0.275, 1095000+(A1-6000000)*0.35)))))

Step 4

Copy the formula which is given above in “step 3”. Now Paste (Ctrl+V) the Formula in cell B1.

Now, the tax payable amount will be calculated based on the taxable income entered in cell A1, and the result will be displayed in the cell B1